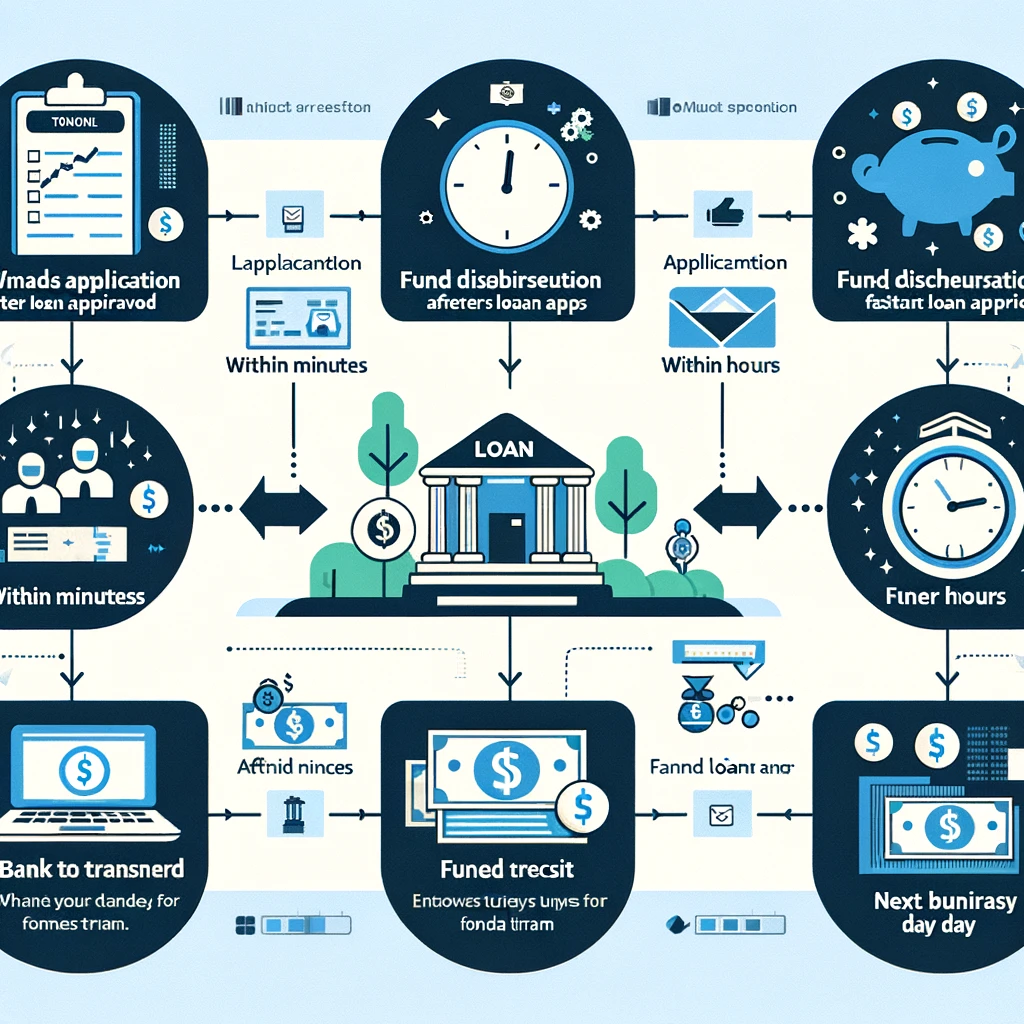

The timeline for users to receive funds after approval can vary significantly, ranging from a few minutes to several days or even longer in certain circumstances receive funds: If you need instant loan app a personal loan then you can apply application of Instant Funds. Search on Play Store Instant Funds. Then download the app. Then register with your number. After some time Instant Funds team will call you. If you need instant loan app then you can apply from instant funds.

Instantaneous of receive funds:

Some payment methods, such as instant bank transfers or certain digital wallets, allow for funds to be received almost instantly after approval. This is particularly common for domestic transactions within the same banking network or using instant payment platforms.

Same Day:

For traditional bank transfers or direct deposits, funds may typically be received on the same day if the approval occurs during banking hours and the transfer is processed promptly. However, this can vary depending on factors such as cut-off times and intermediary banking processes.

Next Business Day:

If the approval occurs outside of banking hours, on weekends, or during holidays, or if the financial institution has specific cut-off times for processing transactions, funds may be received on the next business day.

Several Business Days:

In some cases, especially for international transfers or transactions involving multiple financial institutions, it may take several business days for funds to be received after approval. Delays can occur due to factors such as currency conversion, intermediary bank processing, and differing banking regulations.

Extended Delays:

In certain situations, such as complex transactions requiring additional documentation or approvals, legal or regulatory compliance checks, or investigations into potential fraud or suspicious activity, the time it takes to receive funds after approval can be extended significantly, potentially stretching to weeks or even months.

Complex Transactions of receive funds:

Transactions involving multiple parties, intricate contractual arrangements, or non-standard terms can require extensive documentation, negotiation, and coordination. Each step in the process adds time, particularly if legal or financial experts need to review the transaction details thoroughly.

Legal and Regulatory Compliance:

Compliance with local and international laws, regulations, and industry standards is crucial for financial transactions. Compliance checks may involve verifying the identities of parties involved, screening for sanctioned entities, assessing the legality of the transaction’s purpose, and ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) requirements. Any discrepancies or concerns may trigger additional scrutiny, leading to delays receive funds.

Dependent on External Factors:

External factors beyond the control of the financial institution or payment service provider, such as technical glitches, network outages, or disruptions in the global financial system, can also lead to delays in fund transfers.

Technical Glitches:

System failures or technical glitches within the payment processing infrastructure of banks, financial institutions, or payment service providers can disrupt the normal flow of transactions, leading to delays in fund transfers. Resolving these issues may require IT troubleshooting and system maintenance, which can take time.

Network Outages:

Interruptions in communication networks, such as internet outages or disruptions in telecommunications infrastructure, can impede the transmission of transaction data between relevant parties. Users may experience delays in fund transfers until connectivity issues are resolved receive funds.

Global Financial System Disruptions:

Events affecting the stability of the global financial system, such as economic crises, geopolitical tensions, or regulatory changes, can have ripple effects on the processing of international transactions. Increased scrutiny, regulatory compliance checks, or changes in currency exchange rates may contribute to delays in fund transfers.

Regulatory Compliance Checks:

Stringent regulatory requirements imposed by authorities in different jurisdictions may necessitate thorough compliance checks for certain types of transactions, particularly those involving cross-border transfers, high-value amounts, or sensitive industries. Compliance reviews can involve extensive due diligence procedures, document verification, and regulatory approvals, contributing to delays in fund disbursement.

Investigations into Fraud or Suspicious Activity:

Financial institutions and payment service providers are obligated to monitor transactions for signs of fraudulent activity or suspicious behavior. If a transaction triggers red flags or requires further investigation, funds may be placed on hold pending the completion of fraud detection procedures or anti-money laundering checks, resulting in prolonged delays for legitimate users.